- RSUs on a standalone basis are easier to understand compared to other forms of equity compensation, however, proactive planning is required to maximize the after-tax value of RSUs that are a component of a larger portfolio of differing equity grants.

- Intentionally matching equity grant income with taxable income reduction strategies can result in greater after-tax value of equity awards.

- It’s possible to postpone the delivery of RSUs – which would also postpone the ordinary income tax liability

It’s common practice for large organizations to adopt annual equity programs that issue grants to key employees through a mix of equity-linked forms of compensation. Typically, this will be a combination of RSUs (Restricted Stock Units) and stock options. Each award has unique tax attributes that should be evaluated and proactively planned for to maximize the after-tax value of the equity awards. Formulating an optimal plan to recognize income from various forms of equity compensation can get complicated quickly. As a starting point, consider the following strategies to maximize the benefit of your equity compensation package.

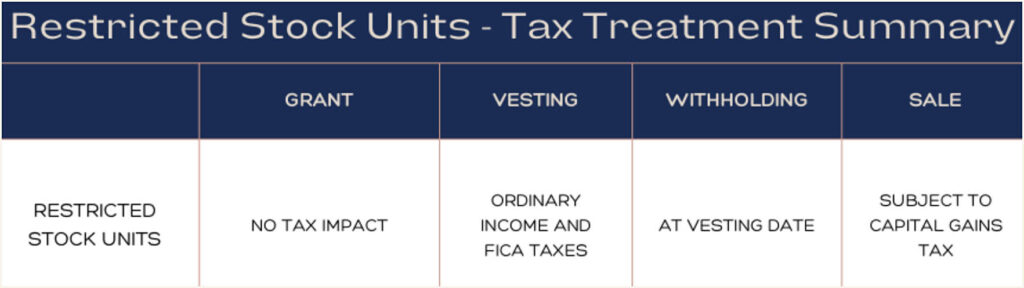

How are RSUs Taxed?

There is no tax impact at the date of grant for RSUs. Typically, when the shares vest they are taxed at ordinary income rates and are also subject to payroll taxes. Tax withholding occurs on the vesting date at supplemental rates (Usually 22%; Amounts over $1M will have 37% federal withholding). Shares that aren’t immediately liquidated will be subject to capital gains tax similar to any other position in a taxable portfolio.

Strategy #1 - Evaluate opportunities to reduce income in years RSUs vest

- Maximizing 401k Contributions – Deferring salary to a workplace retirement plan will reduce your taxable income. If you aren’t already maximizing contributions, adjust your deferral percentages (pre-tax) to account for the additional income that will be recognized when your RSUs vest.

- Bunching Charitable Contributions – If gifting to charity is important to you, consider ‘bunching’ charitable contributions in the year of vesting. This strategy has the potential to drive down your taxable income to offset the income recognized from the vesting of your RSUs.

Tax Planning Note > Consider gifting appreciated securities to a Donor Advised Fund (DAF) to maximize tax efficiency. Gifting LTCG (long-term capital gain) property effectively allows you to ‘give away the gain’ and deduct the FMV of the securities transferred to the DAF. So, the charities that are important to you receive the full value of the securities, and you benefit from avoiding having to pay long-term capital gains tax. Everybody wins! - Max out Health Savings Account (HSA) contributions – If you participate in a high-deductible health insurance plan that is HSA eligible, consider making the maximum contribution in the year of vesting. Like 401k contributions, these deferrals will reduce your income and help offset the income from your RSUs.

- Tax Loss Harvesting – If there are unrealized losses in the taxable portion of your investment portfolio, consider harvesting losses to recognize the tax benefit (up to $3,000 of capital losses can offset ordinary income in a tax year). You can turn around and immediately reinvest the proceeds as long as it isn’t in the same or substantially similar security.

- Utilization of nonqualified deferred compensation plans – Nonqualified deferred compensation plans can be strategically used to defer bonuses or salary to future tax years. This allows you to manage your income tax exposure, with the added benefit of increasing your retirement account savings.

Strategy #2 - Avoid recognizing income from other equity awards in the same tax year RSUs vest

Exercising nonqualified stock options in the same year restricted stock units vest could inadvertently push you into a higher marginal tax bracket. That can lead to some, or all of your equity award being taxed at a higher rate. It’s important to remember you can control when income is recognized from the exercise of NQSOs, so it’s crucial to develop an exercise strategy that is tax-efficient and coordinates with other equity awards.

Strategy #3 - If possible, consider postponing share delivery

It’s possible to postpone the transfer of RSU shares (which also postpones the associated tax liability). This is stock plan dependent, so it’s important to review your company’s plan documents to see if you could benefit from this strategy. The main benefit here is to (hopefully) defer the recognition of income to a year when your tax rates will be lower. This strategy comes with several different layers of risk, as the future stock price and tax rates are unknown.

Equity compensation planning can get complicated quickly. It’s important to take a proactive approach to planning for equity awards to ensure you are maximizing your after-tax benefits.

If you have questions or would like to learn more, please schedule time with me here so we can have a personalized conversation.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.