Key Takeaways -

- Stock options can be a great tool to accelerate wealth creation, but they come with unique tax characteristics that warrant careful consideration before making irrevocable decisions.

- Options have leverage which can dramatically impact their value, both to the upside and downside.

- If you’ve been awarded incentive stock options (ISOs) it’s critical to understand Alternative Minimum Tax (AMT) as exercising and holding ISO shares could result in paying tax on phantom income (money you didn’t receive).

You did it. After years of climbing the corporate ladder, you finally get to participate in the financial rewards of your company’s stock price appreciation alongside the rest of the executive team. It almost doesn’t seem real, but the ‘Action Required’ email indicating you need to log into E*Trade and accept your grant agreement for your options is tangible proof your annual compensation will be forever tied to your company’s stock price performance. So now what?

Understanding Your Options

Equity grants are complex legal documents that are fairly difficult to understand for those without extensive experience reviewing their key terms and conditions. Fortunately, most of the critical information can be extracted from the first few pages of the grant notice. Below are a few key questions to consider as you review your equity award.

1. What type of options do you have? There are two types of stock options. Nonqualified stock options (NQSOs) and qualified stock options, which are more commonly known as incentive stock options (ISOs). Step one is understanding what type of options you’ve been awarded. You’d think this information would be easily identifiable on a stock option award grant notice, but that’s not always the case (see below for an example of the fine print from a sample stock option award agreement – Most folks aren’t seeing that unless they are specifically searching ‘Nonqualifed Stock Option’ in a PDF).

2. How many options do you have? When is the expiration date, and what is the exercise price? This information can usually be found on the first page of your stock option award grant notice.

3. What is the vesting schedule? Vesting is a term used to define the period in which an employee ‘earns’ full ownership of the equity award after meeting certain conditions that are detailed in the equity award agreement. Typically, vesting schedules are time-based, meaning an employee will gain access to their equity after being employed for a predefined period of time. Time-based vesting can be further broken down to ‘cliff’ and ‘graded’ vesting schedules. Cliff vesting is when an entire grant is earned all at once (E.g. after 3 years), while graded vesting allows for access to a percentage of the grant annually (E.g. 33% each year for 3 years).

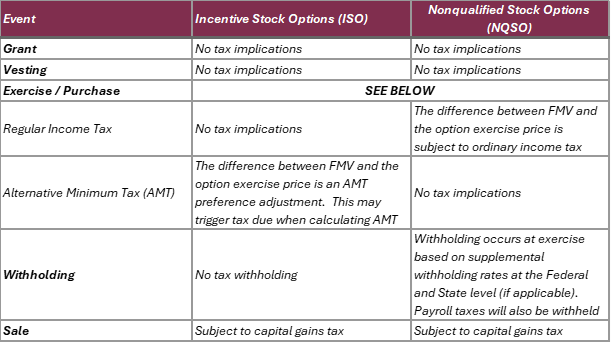

4. What are the tax implications? – Stock option taxation is complicated. At a high level, it’s important to understand ISOs may qualify for preferential tax treatment under certain circumstances. The table below outlines some of the key taxation features of ISOs and NQSOs.

* It’s important to note that exercising ISOs could create phantom income via AMT. Without proper planning, this could be unexpected, and significantly increase an individual’s tax liability.

5. What is the termination impact? Typically, you can exercise vested options within an accelerated timeframe when your employment ends. It’s important to review the post-termination exercise period in the stock plan documents to accurately calculate the exercise deadline. Unvested options at termination are usually forfeited.

Understand the Basics of Option Leverage

When viewed through the lens of investing, leverage is often thought of as additional risk. However, when it comes to stock options, leverage is inherent and by better understanding how leverage impacts the value of your options you can make more informed decisions about how they fit into your investment portfolio and financial plan. So, what is option leverage? Effectively it’s when the percentage change in the value of your options is greater than the percentage change in the underlying stock price. To illustrate the concept, let’s assume you have 10,000 options with an exercise price of $5 per share and a $10 current FMV.

As you can see, in this hypothetical example, a 50% increase in the stock price results in a 100% increase in the value of the stock options. That’s the impact of stock option leverage. You may also notice that as the spread between the exercise price and FMV of the stock increases, leverage starts to diminish.

This is important information to understand and consider when evaluating exercise decisions when you’ve been awarded multiple tranches of stock options. As a general rule, it typically makes sense to exercise options that have low leverage and are approaching expiration. That said, exercise decisions should be coordinated with the rest of your financial plan with careful consideration given to tax implications.

Pause & Plan

Rarely do immediate decisions need to be made regarding your stock options. The first step toward making informed decisions about your equity award is getting and reviewing the stock plan and grant documents. From there, it’s important to have a system that tracks and organizes the grant details so you can calculate important metrics like pre-tax and after-tax value, leverage, and portfolio concentration percentages. In simple situations this can be done in excel, however in most cases individuals would greatly benefit from working with professionals that have access to more robust equity compensation and tax planning software.

If you have questions or would like to learn more, please schedule time with me here so we can have a personalized conversation.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.