Key Takeaways -

- The idea of paying long-term capital gains rates instead of ordinary income tax rates on Incentive Stock Options is appealing, but it’s important to not let tax considerations drive your entire decision-making process.

- An intentional disqualifying disposition can be an effective method to incorporate into a liquidation strategy for your incentive stock options to mitigate the risks associated with holding a sizable position in a single stock.

- Qualifying dispositions force you to hold stock for one-year post-exercise. If the stock price is falling the benefit of preferential tax treatment on Incentive Stock Options can be more than offset by a reduction in share value. This may leave you wishing you would have simply sold the stock immediately at exercise.

Everyone wants to pay as little tax as possible, and there are few things more gratifying than executing strategies that allow you to capture meaningful tax benefits. So, why would anyone voluntarily elect to pay more tax when exercising and selling Incentive Stock Options? Before answering that question it’s important to understand the key features and tax implications of Incentive Stock Options.

What is an Incentive Stock Option?

Incentive stock options (ISOs) are a type of stock option with unique characteristics that allow them to qualify for preferential tax treatment if certain conditions are met. The summary below highlights several key attributes of ISOs.

Special Tax Treatment:

- ISOs may qualify for unique tax benefits under the Internal Revenue Code.

- Exempt from Social Security, Medicare, and withholding taxes.

Qualification Criteria:

- Available only to employees, not to consultants or contractors.

Grant Limitations:

- A maximum of $100,000 in ISOs can become exercisable in any calendar year.

Post-Employment Conditions:

- To maintain special ISO tax benefits, employees must exercise their ISOs within three months after leaving the company.

Taxes on Incentive Stock Options

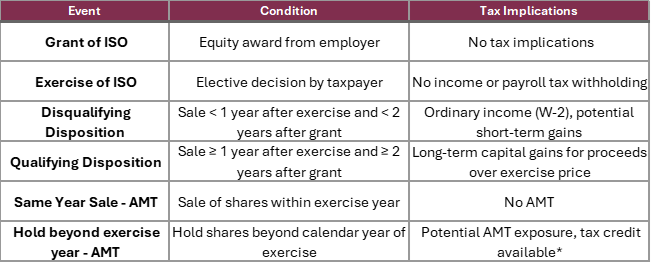

Incentive stock option taxation is complicated. One must carefully evaluate the advantages and disadvantages of exercising and holding ISOs (for potential lower capital gains tax rates) or exercising and selling ISOs immediately. Prior to diving into the potential advantages of intentionally triggering a disqualifying disposition (exercising and selling immediately), it’s important to have a baseline understanding of ISO tax treatment. The following table highlights key events, conditions, and tax considerations associated with Incentive Stock Options.

* Planning Note > The Alternative Minimum Tax (AMT) tax credit for ISOs allows taxpayers who have paid AMT due to exercising ISOs to potentially recoup some of that tax in future years. When you exercise ISOs, the difference between the exercise price and the fair market value of the stock is included as income for AMT purposes, which can result in a higher tax bill. However, this AMT payment generates a credit that can be used to offset regular tax in future years when AMT is not triggered, effectively reducing your tax burden over time. This credit can be carried forward indefinitely until it is fully utilized.

Disqualifying Dispositions - Consider more than just taxes

The appeal of potentially reduced income tax rates can drive individuals toward a quick decision to pursue a qualifying disposition with their Incentive Stock Options. However, it’s crucial to recognize that preferential tax treatment isn’t the sole consideration when deciding on a strategy for exercising ISOs and offloading shares.

Below are a handful of reasons to consider intentionally choosing a disqualifying disposition of ISOs.

- Bird in the hand – Will taking chips off the table immediately help you achieve a meaningful financial goal? If so, is that worth risking just to achieve an optimal tax solution? A severely underappreciated benefit of voluntarily executing a disqualifying disposition is certainty. Locking in profits now (albeit at a higher tax rate) means avoiding uncertainty about the future stock price later.

- Portfolio Optimization – Divesting a large stock holding – Pursuing a qualifying disposition may not be prudent for those who prioritize diversification over concentration risk or tax benefits. Holding a single stock position involves balancing risk and reward, which should be evaluated within the context of a broader financial plan. The potential benefits of improved tax treatment may or may not justify the risk.

- Cash Flow – To capture the full benefit of a qualifying disposition, one must have adequate cash reserves to purchase the shares at the exercise price listed in the option agreement. Depending on the size of the equity grant, this may be a substantial amount of cash. Alternatively, a disqualifying disposition can support immediate liquidity needs, which might be necessary for personal expenses or other investment opportunities.

- Tax Simplification – A disqualifying disposition can help avoid the complexities of alternative minimum tax (AMT) exposure. In addition to AMT avoidance, tax reporting is greatly simplified which could be a potential benefit for those who elect to self-prepare their personal tax returns.

Final Thoughts

While disqualifying dispositions of Incentive Stock Options (ISOs) might not offer the tax advantages associated with qualifying dispositions, they provide several significant benefits that can align better with an individual’s financial goals and risk tolerance. From immediate liquidity and avoidance of the Alternative Minimum Tax (AMT) to simplified tax reporting and reduced market risk, disqualifying dispositions can be an appropriate strategic move for many investors. Ultimately, the decision should be made in the context of one’s overall financial plan, considering both the potential benefits and the trade-offs involved.

If you have questions or would like to learn more, please schedule time with me here so we can have a personalized conversation.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.