Key Takeaways

- ESPPs allow you to purchase company stock at a discount, typically 5-15% off the market price

- Participation is voluntary and contributions are made through payroll deductions

- Some ESPPs are a screaming deal, while others may not be worth the hassle.

- Two critical components to look out for are a lookback provision and a holding period requirement

Introduction to Employee Stock Purchase Plans (ESPPs)

Employee Stock Purchase Plans (ESPP) offer a unique opportunity to invest in your employer’s stock, often at a discount, making them a nice arrow in the quiver for building wealth.

By offering you the chance to buy company stock at a discount, ESPPs give you an immediate head start on potential stock appreciation. This can be especially valuable if you believe in your company’s long-term prospects and want to align your financial success with its growth.

But ESPPs aren’t just about potential stock appreciation. They’re also about creating a disciplined savings habit.

When you enroll in an ESPP, you’re committing to setting aside a portion of your paycheck regularly. This forced savings can help you build wealth over time, even if you’re not a natural saver.

And because the contributions come out of your paycheck before you see the money, you might find it easier to adjust your spending habits accordingly.

Employee Stock Purchase Plans have their own unique language that can be wildly confusing for those unfamiliar with the terminology. To help you confidently assess your ESPP, here are some key definitions you should know:

- Offering Period: The timeframe during which employees can acquire company shares at a discounted rate. These periods commonly span 12 or 24 months.

- Enrollment Date (AKA Grant Date): The date when participation in the plan begins, kicking off the subsequent Purchase Period.

- Purchase Period: Each Offering Period includes multiple Purchase Periods, generally lasting around 6 months. This duration dictates the number of payroll deductions taken to buy company stock.

- Lookback Provision: A feature in some ESPPs allowing the purchase price to be the lower of the stock price on either the Enrollment Date or Purchase Date, in addition to the offered discount.

Mechanics of ESPPs

When you join an ESPP, you’re entering a structured program with specific timelines and rules. Most plans operate on a cycle of offering periods, which usually last 6 to 24 months.

Within each offering period, you’ll find one or more purchase periods, often 3 or 6 months long.

Here’s how the process typically works:

- Enroll in the plan and choose the percentage of your salary you want to contribute.

- Your company deducts this contribution from each paycheck during the Offering Period.

- Note > If you decide to max out ESPP participation in a plan with a 15% discount, you can expect a reduction in monthly take-home pay of about ~$1,750 ($25,000 x 0.85 = $21,250 / 12 months = $1,750)

- At the end of each Purchase Period, your company uses the accumulated funds to purchase shares on your behalf.

- The shares are bought at a discount off the stock price and deposited to a taxable brokerage account at Fidelity, Schwab, etc.

Key Feature #1 - Lookback Provision

The lookback provision is a key plan feature that has the potential to significantly boost your potential returns.

If your plan includes a lookback provision, you get to buy shares at a discount from the lower of two prices: either the price at the start of the offering period or the price at the end of the purchase period.

This can be particularly beneficial in a rising market, as you might get to purchase shares at a price from several months ago, plus an additional discount.

Key Feature #2 - Holding Period Requirement

Finally, a holding period requirement is an often overlooked variation in plan design. This means the company may force you to hold the ESPP shares for a period of time (E.g. 1 Year) before you can liquidate your positions.

This is a key variable that should be verified prior to ESPP participation, as this introduces market risk and may dictate how much cash you are comfortable allocating toward your employer stock.

Understanding these nuances in your company’s plan is key to making informed decisions about your participation.

ESPP Participation Considerations

So, the big question – Should you sign up for your company’s ESPP?

Probably, but it’s not always a simple decision.

Is there a 15% discount, a lookback provision, and no holding period requirement? Those attractive terms are typically hard to pass up.

What about a plan with a small discount and no lookback provision? It’s not a hard no, but it may not be worth the hassle factor.

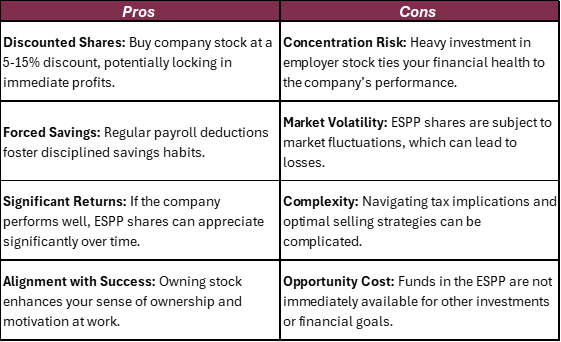

Here’s a high-level summary of pros and cons to consider when evaluating your ESPP.

Final Thoughts

How you manage your ESPP contributions and shares will depend on your personal circumstances and overall financial strategy.

That said, a good rule of thumb is to limit your company stock holdings (including ESPP shares, stock options, and any other equity compensation) to no more than 10-20% of your overall investment portfolio. This helps maintain diversification and reduces your exposure to company-specific risk.

Remember, the key to successful financial planning is balance. While the potential benefits of an ESPP can be attractive, it is important not to overcommit.

If you have questions or would like to learn more, please schedule time with me here so we can have a personalized conversation.

Want to receive exclusive insights delivered to your inbox every other Saturday? Sign up for RLN Wealth’s newsletter.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.