Is your money working for you, or are you working for your money? This question often gets lost amidst spreadsheets and investment portfolios.

Traditional financial planning focuses on numbers:

- How much you need to save

- What returns you should target

- When you can retire

But these numbers don’t mean much if they aren’t supporting a life that brings you joy and fulfillment.

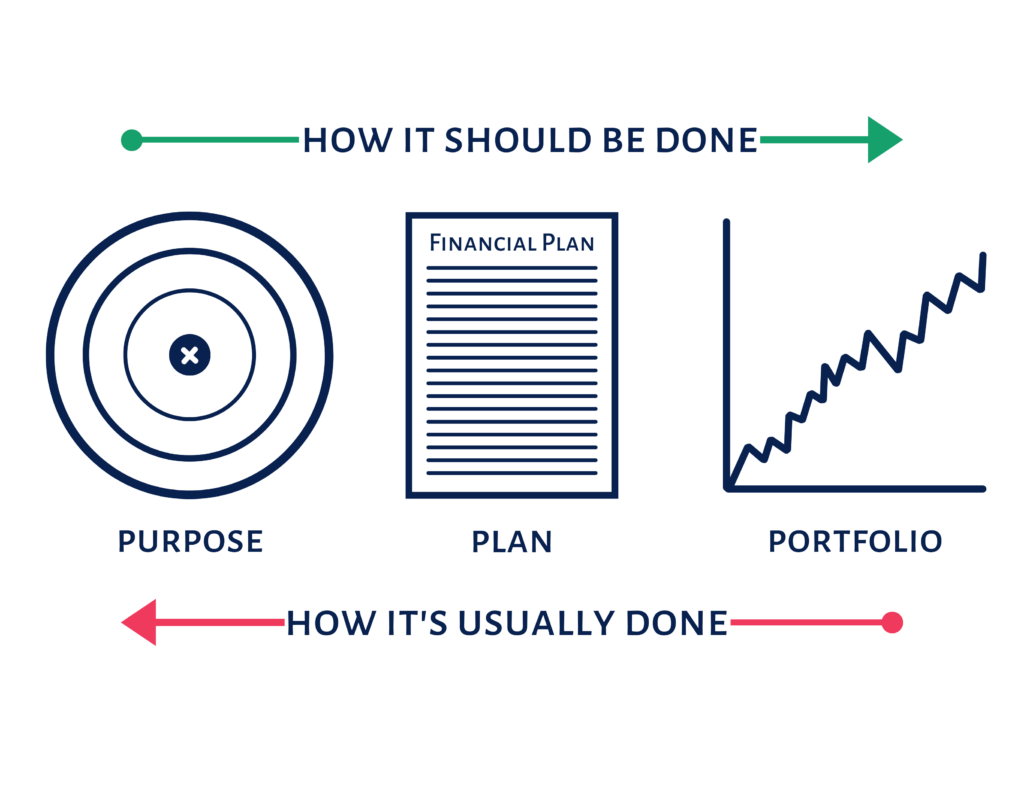

This is where life-centered financial planning comes in. It’s a nontraditional approach that begins with your vision of an ideal life and then aligns your finances to support it. Instead of asking, “How much money do I need?” life planning asks, “What do I want my life to look like?”

Why Life-Centered Financial Planning?

Life-centered financial planning takes a holistic view of your entire life, and recognizes that true wealth isn’t just about the size of your bank account—it’s about creating a life rich in experiences, relationships, and purpose.

By integrating life planning with financial planning, we can create a powerful framework for decision-making. Your personal values and life goals become the compass guiding your financial choices.

Whether your dream is to start a business, travel the world, or pursue creative passions, these aspirations shape your financial strategy, making decisions clearer and more meaningful.

This blog will explore how to:

- Define your ideal life

- Align your finances with those goals

- Adapt as your life evolves

By the end, you’ll have a roadmap for both financial success and a life well-lived.

Defining Your Optimal Life

Defining your optimal life is a personal journey. It requires self-reflection and honesty. Start by asking yourself:

“If money were no object, how would I spend my days?”

This simple question can unlock insights into your passions and priorities. Then, consider your core values:

What principles guide your decisions? What brings you a sense of purpose?

These values form the foundation of your life plan. They might include family, creativity, adventure, or community service.

Once you’ve identified your values, think about how they translate into long-term aspirations.

Perhaps you envision a life where you can work remotely while exploring new cultures, or maybe you dream of building a sustainable homestead. The key is to let your imagination roam free, unconstrained by current limitations.

Visualizing Your Future

Visualizing your ideal future is a powerful tool in life planning. Close your eyes and picture your life in 5, 10, or 20 years:

- What are you doing?

- Who are you with?

- How do you feel?

This exercise not only helps clarify your goals but also creates an emotional connection to your future self. And your vision becomes the north star for your financial planning, guiding decisions about savings, investments, and career choices.

Remember, your optimal life is unique to you. By defining what truly matters, you’re laying the groundwork for a financial plan that grows your wealth and enriches your life.

Aligning Financial Strategies with Life Goals

Now that you’ve defined your ideal life, it’s time to align your financial strategies with those aspirations. Here’s how common life goals translate into financial strategies:

- Early Retirement: Focus on aggressive savings and explore passive income strategies such as real estate or a dividend-paying portfolio.

- Starting a Business: Build a robust emergency fund and evaluate flexible financing options.

- World Travel: Maximize credit card rewards, prioritize experiences over wealth accumulation, and consider remote work opportunities.

This approach transforms financial planning from a chore into a tool for realizing your dreams. Suddenly, your 401(k) balance isn’t just a number—it’s about buying your freedom to pursue passions earlier in life.

Remember, flexibility is key. Your financial strategy should adapt as your goals evolve. Whether it’s adjusting investments or reallocating resources, think of your financial plan as a living document.

Ongoing Life and Financial Planning

Life planning and financial planning are ongoing processes that evolve as you do. Just as your life changes, your goals and financial strategies should adapt to keep pace. That’s why it’s important to schedule regular check-ins with your spouse and/or team of advisors to reassess your life plan and financial roadmap.

At least once a year, ask yourself:

- Are my current goals still aligned with what I want?

- Have new aspirations emerged?

- Has my definition of an ideal life shifted?

This isn’t about overhauling your plan each year but fine-tuning it. As your life changes, adjust your financial strategies. For example:

- Shift funds from a 401k contribution to a travel fund if you now prioritize experiences.

- Explore socially responsible investments if sustainability is important to you.

By regularly aligning your financial strategies with evolving life goals, you create synergy between your money and your dreams.

A Holistic Approach to Wealth

Ultimately, financial success isn’t just about account balances or investment returns. It’s about how well your finances support a life of joy, purpose, and fulfillment.

By keeping your life goals at the center of your financial decisions, you ensure that your money works for what matters most to you.

After all, the goal isn’t just to be wealthy—it’s to live well.

If you have questions or would like to learn more, please schedule time with me here so we can have a personalized conversation.

Want to receive exclusive insights delivered to your inbox every other Saturday? Sign up for RLN Wealth’s newsletter.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.