As CoreWeave gears up for its anticipated IPO, employees with equity compensation—such as stock options and RSUs—should start to plan strategically for a significant financial windfall.

A well prepared approach can help mitigate unintended consequences, improve tax outcomes, and align equity decisions with long-term financial goals.

Ready to learn more?

Below is a quick reference guide to prepare for CoreWeave’s upcoming IPO later this year.

1. Understanding Your Equity Compensation

CoreWeave’s S-1 Filing (a public disclosure document filed with the SEC to formally begin the IPO process) indicates that its 2025 Equity Incentive Plan grants various equity awards to employees, directors, and consultants.

Unfortunately, each form of company equity comes with distinct tax characteristics, so careful consideration and planning is required well in advance of a liquidity event to achieve optimal tax and portfolio outcomes.

So, the first thing you need to consider is what type of equity you’ve been awarded.

Here’s a quick rundown of the most common forms of equity compensation for CoreWeave employees.

- Restricted Stock Units (RSUs) – By far the most common form of equity comp, RSUs are typically granted with a multi-year vesting schedule. RSUs are taxable as income upon vesting, and are subject to payroll taxes.

- Stock Options (ISOs & NSOs) – Stock Options give you the right to purchase shares at a predetermined price. Incentive Stock Options (ISOs) have tax advantages but require careful planning to avoid Alternative Minimum Tax (AMT). Non-qualified options (NSOs) are a lot like RSUs, with the key difference being that you can control the timing of the tax event.

- Stock Appreciation Rights (SARs) – SARs are an equity-linked form of compensation that rewards employees for stock price appreciation during a preset period of time. They are similar to NSOs, but don’t require the purchase of shares upon exercise.

Planning Note > Pertinent details related to your equity compensation can be found in your grant award agreement. These documents should be reviewed in their entirety to ensure a complete understanding of the terms and conditions related to your equity award.

Key Questions to Ask:

- What are the vesting schedules and expiration dates for my RSUs and stock options?

- Should I exercise options before or after the IPO?

2. Plan for Tax Implications

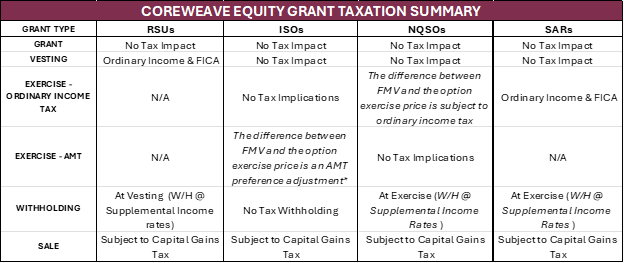

Planning for taxes related to company stock can get complicated quickly.

Multi-year exercise strategies and tax projections, avoiding phantom income recognition from option exercises, and tax withholding are just a few of the key factors employees must consider before making potentially life-changing financial decisions.

So where do you begin?

Step #1 is getting a baseline understanding of how your equity is taxed.

Here’s a quick summary of key points to be aware of regarding the taxation of CoreWeave equity compensation.

RSU Taxation at Vesting

- RSUs are taxed as ordinary income at vesting, based on the stock’s fair market value.

- Planning Note > Consider a sell-to-cover strategy to automatically sell a portion of your shares to cover the tax bill.

Stock Options and the AMT Factor

- Exercising ISOs does not trigger ordinary income tax immediately, but the spread (difference between exercise price and market value) counts toward AMT.

- NSOs, on the other hand, generate taxable income upon exercise, subject to ordinary income tax.

- Strategies such as early exercising before the IPO or staggering exercise over multiple tax years can help manage AMT exposure.

Capital Gains Tax Considerations

- Holding ISO stock for over one year post-exercise (and two years from grant date) qualifies for long-term capital gains tax rates.

- Post IPO stock prices can be volatile, so it’s important to start developing a tax liquidation plan well in advance of lockup expiration.

Key Questions to Ask:

- What are my estimated tax liabilities from RSUs and stock options?

- Should I exercise options before or after the IPO?

- If I hold ISOs, how does exercising them impact my AMT liability?

3. Develop a Diversification Strategy

Avoid Overconcentration in CoreWeave Stock

- While holding company stock can be lucrative, overconcentration (typically defined as more than 10-15% of your portfolio) can expose you to significant single stock risk.

- A structured selling plan can not only manage your tax liabilities but will also help rebalance your portfolio over time.

10b5-1 Trading Plans

- A 10b5-1 plan gives executives and employees the option to pre-schedule stock sales, significantly reducing exposure to insider trading concerns.

- Establishing a plan early can help manage liquidity while avoiding the emotions of timing stock sales.

Lock-Up Period Considerations

- IPOs typically come with a 6-month lock-up period, restricting employees from selling shares immediately after the stock starts actively trading.

- Be prepared with a liquidity strategy so you are ready to act when the lock-up expires.

Have a Plan

- Having a premeditated, rules based plan laid out in advance of the IPO will allow you to make informed, unemotional decisions about a significant financial event in your life.

Key Questions to Ask:

- What percentage of my net worth is concentrated in CoreWeave stock?

- Should I set up a 10b5-1 plan to sell shares systematically?

- When does my lock-up period end, and what should my post-IPO liquidity plan be?

4. Don't Forget About The ESPP

CoreWeave also disclosed the board of director and stockholders approved a 2025 Employee Stock Purchase Plan (ESPP).

These plans allow employees to regularly (through payroll deductions) purchase company stock at a discount to FMV.

At first glance, CoreWeave’s ESPP looks promising as it provides a 15% discount on the stock price, and a lookback provision!

Of course, adding single stock exposure to your portfolio through an ESPP isn’t typically the optimal outcome so make sure you have a plan to manage your overall company stock exposure if you plan to participate.

Key Questions to Ask:

- How does participating in the ESPP impact my overall exposure to CoreWeave stock?

- Should I sell ESPP shares immediately upon purchase, or hold them for potential tax benefits?

- How does the lookback provision enhance my potential returns, and what are the risks?

5. Work With Financial & Tax Professionals

This is likely a once-in-a-lifetime liquidity event for CoreWeave employees.

You’ll need to make a number of decisions related to your company stock in the coming months, and working with an advisor who understands the nuance of equity compensation taxation and the IPO process might be a valuable resource to have on your bench of advisors.

Here are a few ways a tax and equity comp specialist might be able to help.

Financial & Tax Planning Strategies

- Modeling multi-year tax and investment portfolio scenarios (e.g., stock price appreciation vs. decline, tax obligations, diversification strategies).

- Cash flow planning for significant tax bills, confirming adequate tax withholding and cash reserves are available for future federal and state tax liabilities.

- Evaluation of exercising the maximum amount of ISOs each tax year without triggering AMT.

- Controlling income recognition by spreading option exercises across multiple tax years.

Key Questions to Ask:

- Should you hire a financial planner & CPA that specializes in IPOs and equity compensation?

- Do you have the time, willingness, and ability to accurately prepare federal and state tax projections across multiple tax years?

- Would you value professional, unbiased opinions from experts that regularly guide high net worth individuals through the IPO process?

Final Thoughts

CoreWeave’s IPO presents an exciting opportunity for employees with stock in the company, but proactive planning is key to maximizing financial benefits and minimizing taxes and unintended consequences.

If you need guidance, working with an advisor experienced in IPO transitions and equity compensation can provide clarity and confidence in your strategy.

If you have questions or would like to learn more, please schedule time with me here so we can have a personalized conversation.

Want to receive exclusive insights delivered to your inbox every other Saturday? Sign up for RLN Wealth’s newsletter.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.