Key Takeaways –

- 529 plans offer tax-free growth and withdrawals for qualified education expenses

- The Secure 2.0 Act now allows rollovers from 529s to beneficiary owned Roth IRAs, which can help mitigate the risk of overfunding

- The best strategy typically involves conservative 529 account funding with additional financial resources earmarked in a taxable brokerage account

- 529 plans can be used for a wide range of education costs (not just college tuition)

529 Funding - Planning for Education Expenses

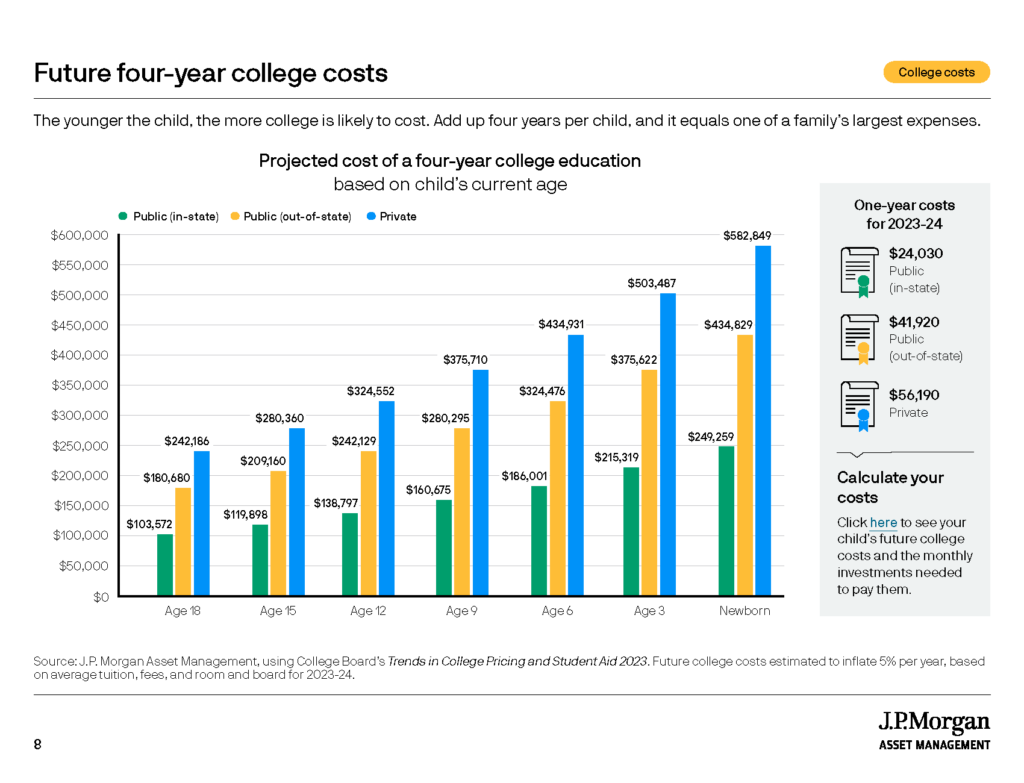

Planning for education expenses is a big deal for many families. With the rising costs of college (see chart below) and other forms of higher education, it’s smart to start saving early. Enter the 529 plan. They’re not just another investment account – they’re a strategic way to grow your money tax-free while earmarking it for education.

*Source: JP Morgan College Planning Essentials: A Comprehensive Guide to Saving & Investing

But 529 plans aren’t the only option out there. In this post, we’ll explore:

- The ins and outs of 529 plans

- Alternative ways to save for education

- New rules allowing 529 funds to roll into a Roth IRA

By the end, you’ll have a clear picture of how 529 plans work and whether they’re the right fit for your family’s education savings strategy.

Pros and Cons of Funding a 529 Plan

A 529 plan can be a powerful tool for education savings, but whether or not they are the right tool for you and your family largely depends on your personal circumstances. As with most tax and personal finance strategies, there are tradeoffs to assess before making major financial decisions.

Here are a few things to consider when evaluating if a 529 college savings plan is right for you.

Pros:

- Tax-Free Growth and Withdrawals: Your investments grow tax-free, and as long as withdrawals are used for qualified education expenses, you won’t owe federal taxes on the investment growth.

- High Contribution Limits: Unlike many other education savings accounts, 529 plans allow you to contribute substantial amounts—up to several hundred thousand dollars—giving you the ability to fully fund a child’s (and potentially their kids) education.

- State Tax Benefits: Many states offer tax deductions or credits for contributions to 529 plans, providing an additional incentive to save. Check your state’s specific benefits to see if you qualify.

- Beneficiary Flexibility: If your child doesn’t use all the funds, you can easily transfer the balance to another family member—whether it’s a sibling, grandchild, or even yourself—without tax penalties.

Cons:

- Qualified Expenses Only: To avoid taxes and penalties, withdrawals must be used strictly for qualified education expenses. If the funds are used for non-educational purposes, you’ll face income taxes and a 10% penalty on the earnings portion.

- Limited Investment Choices: Unlike other types of investment accounts, 529 plans limit you to the options provided by the plan (Similar to most 401k plans). While these are often professionally managed, they may not offer the flexibility some investors prefer.

- Potential Impact on Financial Aid: Although generally minimal, 529 plans are considered parental assets, which could reduce financial aid eligibility by up to 5.64% of the account’s value when calculating need-based aid.

529 Plan Alternatives

It’s hard to beat the tax, estate, and control/flexibility advantages of 529 plans, which is why it’s typically an optimal solution for those looking to save for future education expenses. That said, there are other alternatives out there that should be considered in select circumstances. These options include ESAs (Coverdell Education Savings Accounts), Custodial accounts, and Roth IRAs.

Coverdell Education Savings Account (ESA):

The Coverdell ESA can offer a more versatile approach to saving for education expenses compared to 529 plans. Here are its key features:

- Investment Flexibility: Unlike 529 plans, Coverdell ESAs give you the freedom to invest in a wider range of options, including stocks, bonds, mutual funds, and even certain real estate investments. This could translate to greater growth potential depending on how you manage the account.

- K-12 Eligible Expenses: One of the biggest advantages of Coverdell ESAs is that they can be used for K-12 educational expenses in addition to higher education costs. This makes them a strong option for families planning to fund private school tuition, tutoring, or other educational needs before college.

- Lower Contribution Limits: While Coverdell accounts offer more flexibility, their contribution limits are significantly lower (and sometimes phased out completely) compared to 529 plans. You can only contribute up to $2,000 per year per beneficiary, which may not be enough for some families aiming to cover large portions of future education expenses. However, for families with shorter-term or more modest education savings goals, a Coverdell ESA can be an excellent complement to other savings strategies.

Custodial Accounts (UTMA/UGMA):

Custodial accounts, sometimes referred to as UTMA/UGMA accounts, provide another option for education savings. Here are a few key features of these accounts:

- Flexibility in Fund Usage: Unlike 529 and Coverdell accounts, UTMA/UGMA custodial accounts offer no restrictions on how the funds are used. Once the child reaches the age of majority (typically 18 or 21, depending on the state), the money is fully under their control and can be spent on anything, not just education. This can be beneficial if your child ends up needing funds for purposes other than schooling, such as starting a business, buying a home, or even traveling.

- No Tax Advantages: UTMA/UGMA accounts lack the tax benefits provided by 529 plans and Coverdell ESAs. The account’s earnings are subject to taxation, although at a lower rate due to the child’s lower tax bracket. This can erode some of the savings potential over time, making custodial accounts less appealing for those focused solely on tax-efficient growth.

- Financial Aid Impact: It’s also important to note that custodial accounts are considered the child’s assets, which can have a more significant impact on financial aid eligibility. Because financial aid formulas typically weigh a child’s assets more heavily than parental assets, having large amounts in a UTMA/UGMA account may reduce the financial aid package your child is eligible for.

Roth IRA:

A Roth IRA, traditionally used as a retirement savings account, can also double as a flexible option for education savings. Here’s how:

- Penalty-Free Education Withdrawals: One of the standout features of a Roth IRA is the ability to withdraw contributions (but not earnings) at any time without facing taxes or penalties. If you need to tap into the funds for education expenses, you can do so without penalty, even if the funds aren’t earmarked explicitly for educational purposes like in a 529 plan.

- Dual-Purpose Account: The Roth IRA offers the unique advantage of serving as both an education savings tool and a retirement savings vehicle. If the funds aren’t used for education, they can remain in the account and grow tax-free until retirement. This provides a level of flexibility that’s hard to match with other education-specific accounts.

- Annual Contribution Limits: Keep in mind, Roth IRAs come with contribution limits—$7,000 per year (or $8,000 if you’re over 50 in 2024). Also, unlike 529 plans, Roth IRA contributions must come from earned income, and there are income limits that may reduce or eliminate your ability to contribute if your income exceeds a certain threshold.

- Balancing Retirement and Education Goals: Since Roth IRAs are primarily designed for retirement, you must carefully balance your long-term retirement goals with short-term education needs. Withdrawing too much for education could diminish your retirement savings down the line, so this strategy works best for those with excess income or additional savings earmarked for retirement.

Changes Brought by the Secure 2.0 Act

The Secure 2.0 Act, passed in late 2022, introduced a significant change for 529 plans. Starting in 2024, unused 529 funds can be rolled over into a Roth IRA owned by the 529 account beneficiary. This is a significant planning opportunity for young families saving for education because it allows the following:

- Greater Flexibility: You can redirect leftover 529 funds towards retirement, avoiding penalties for non-qualified withdrawals.

- Jumpstart Retirement Savings: Excess education savings can now give your child a head start on their long-term financial security.

Before getting too excited, please note the following rollover rules and limitations:

- The 529 account must have been open for at least 15 years.

- A lifetime rollover limit of $35,000 applies.

- Annual rollovers are capped at the IRA contribution limit (minus any other contributions).

- The beneficiary’s income must fall within Roth IRA limits.

Note > These requirements are in place to prevent the rollover option from being a loophole to bypass IRA limits, while also encouraging long-term savings in 529 plans.

Actionable Advice for Education Savings

If you’re contemplating utilizing a 529 plan, or trying to optimize your current education savings, consider the steps below to ensure you are on the right track.

- Research Your State’s 529 Plans—(FYI – It may be beneficial to utilize a plan outside of your home state!):

- You state may offer potential tax breaks on contributions made to in-state 529 plans.

- It’s also important to compare fees, investment options, and performance prior to selecting a 529 plan.

- Planning Note > Some states are defined as ‘Tax Parity’ states, which offer a tax deduction for contributing to ANY 529 plan, while others only offer tax incentives when contributing to in-state 529 plans. There are also (13) states that offer no state tax deduction for 529 contributions.

- You state may offer potential tax breaks on contributions made to in-state 529 plans.

- Start Contributing Early:

- Even small, regular contributions can make a significant impact when invested over a 15+ year time horizon.

- The best way to get started is to set up small automatic withdrawals from a checking / savings account that are deposited directly into the 529 plan.

- Even small, regular contributions can make a significant impact when invested over a 15+ year time horizon.

- Involve Family:

- Grandparents or relatives can contribute to the account and its usually as simple as providing them with a code to make contributions to the 529 account. This not only helps with financing college education, but may also provide valuable estate tax savings for your family members (529 balances are excluded from federal & state estate tax calculations)

- Grandparents or relatives can contribute to the account and its usually as simple as providing them with a code to make contributions to the 529 account. This not only helps with financing college education, but may also provide valuable estate tax savings for your family members (529 balances are excluded from federal & state estate tax calculations)

- Integrate into Your Broader Financial Strategy:

- It’s important to balance the tradeoff between education savings with retirement saving/planning. Retirement planning should always come first (you can borrow for education, not retirement!). Also, understand there are many financing options (Student Loans, HELOC, etc.) to pay for college education that can help bridge the gap if additional funds in excess of education savings are required.

- It’s important to balance the tradeoff between education savings with retirement saving/planning. Retirement planning should always come first (you can borrow for education, not retirement!). Also, understand there are many financing options (Student Loans, HELOC, etc.) to pay for college education that can help bridge the gap if additional funds in excess of education savings are required.

- Have The End In Mind – Evaluate Overfunding Solutions:

- Understand you can always change the beneficiary to another family member if the original beneficiary doesn’t need the entire 529 account balance.

- If you are in the fortunate position to have excess funds in a 529, consider launching the beneficiary into adulthood by rolling over the balance to their Roth IRA (subject to limitations above).

- Understand you can always change the beneficiary to another family member if the original beneficiary doesn’t need the entire 529 account balance.

It’s normal to feel caught between funding your kids’ education and chasing your own dreams / planning for retirement.

This stress is often magnified by the fact that tuition costs have skyrocketed over the past few decades, and it doesn’t appear that cost inflation will moderate anytime soon.

However, by staying informed and taking some of these small steps, you can build a robust and flexible education savings plan, ensuring peace of mind for your child’s future.

If you have questions or would like to learn more, please schedule time with me here so we can have a personalized conversation.

Want to receive exclusive insights delivered to your inbox every other Saturday? Sign up for RLN Wealth’s newsletter.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.

This material is intended for informational/educational purposes only and should not be construed as investment, tax, or legal advice, a solicitation, or a recommendation to buy or sell any security or investment product. Hypothetical examples contained herein are for illustrative purposes only and do not reflect, nor attempt to predict, actual results of any investment. The information contained herein is taken from sources believed to be reliable, however accuracy or completeness cannot be guaranteed. Please contact your financial, tax, and legal professionals for more information specific to your situation. Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.