- Stock Appreciation Rights (SARs) are an equity-linked form of compensation that rewards employees for stock price appreciation during a preset period of time.

- SARs have many similarities to non-qualified stock options (NQSOs), including the risk of the grant being worthless if the stock price declines after the grant date.

- One benefit of SARs is purchasing shares directly at exercise is not required

Stock Appreciation Rights – What Do You Have?

- Grant Date – The date a SAR is issued to an employee and the vesting period begins

- Vesting Date – The date you are eligible to exercise some or all of your appreciation rights. Equity appreciation before this date cannot be unlocked/accessed.

- Exercise Period – Time between the vesting date and expiration date when payments can be received.

- Exercise Price – The price of the stock on the grant date.

- Expiration Date – The last day of eligibility to exercise the right to receive compensation for the spread between the FMV of the stock at exercise and the strike price. Note – Unexercised SARs held past the expiration date are forfeited!

Grant Date | March 1, 2020 |

Exercise Price | $15.00 |

No. of SARs | 1000 |

Vesting Date | March 1, 2021 |

Expiration Date | March 1, 2030 |

If we assume the value of the SAR on the vesting date (March 1, 2021) is $45/share the total value of your Stock Appreciation Rights is $30,000 ($45/share – $15/share = $30/share * 1,000 rights exercised = $30,000).

Technical Note – Pertinent details related to your SARs can be found in the grant award agreement. This document should be reviewed in its entirety upon delivery to ensure a complete understanding of the terms and conditions related to your equity award.

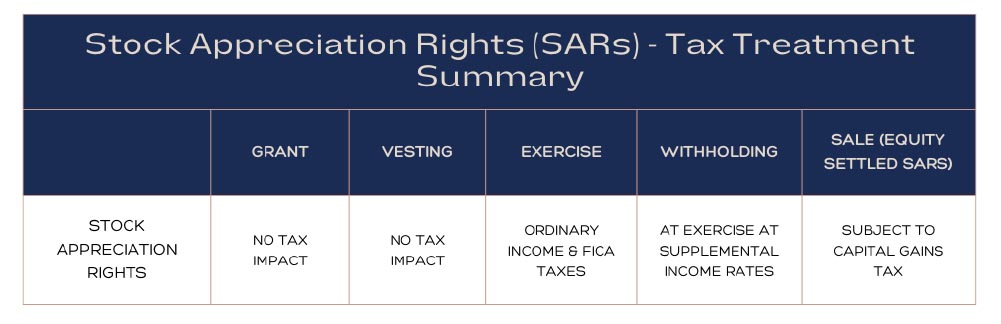

How are SARs taxed?

Receiving a SAR grant, and the eventual vesting of the Stock Appreciation Rights are non-taxable events. At exercise, the difference between the market value and exercise (strike) price is taxed as earned income (reported on your W-2) and subject to payroll tax. Tax withholding will occur at exercise, however, it will likely be at the standard federal supplement income rate of 22% (for amounts under $1M). This could leave you with a surprise come tax time if your income in the year of exercise is pushing you into higher tax brackets.

Note > Equity Settled SARs – If the form of payment is stock, the tax consequences of holding stock post-exercise are no different than holding other shares of stock in a brokerage account (tax implications are a function of price appreciation/depreciation and holding period).

Planning Considerations

1. Tax Planning – SARs allow you to control the timing of income recognition, which can be a significant tax planning benefit. A few tax planning questions that should be addressed prior to exercise are below –

a. Is there a benefit to exercising across multiple tax years?

b. Will the tax withholding at exercise cover the entire tax liability of the SAR income? If not, what is the anticipated tax due when you file your return

c. Do you need to make estimated tax payments in the year of exercise to avoid underpayment penalties?

2. Cash Management – Cash proceeds from equity compensation can be viewed as a way to turbocharge your savings, but it can also be a guilt-free cash source to create memorable experiences with your loved ones. Remember, the goal is to build your life, not just your portfolio. Before making any decisions, it’s important to evaluate how a cash infusion from an equity award fits into your overall financial plan, and don’t forget to earmark funds for additional taxes due when you file your 1040

3. Portfolio Management – If receiving shares of stock, it’s important to understand the broader impact of maintaining that position in your investment portfolio. Building a concentration position is oftentimes an unintended consequence of inadequate equity compensation planning.

Consider reaching out to an advisor with equity compensation experience before making any decisions about your SARs. The right advisor can help you make informed, proactive decisions and give you confidence that you are making optimal decisions for you and your family’s financial future.

If you have questions or would like to learn more, please schedule time with me here so we can have a personalized conversation.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.