Key Takeaways:

- A mega backdoor Roth strategy can be a powerful savings accelerant, but it’s not for everyone.

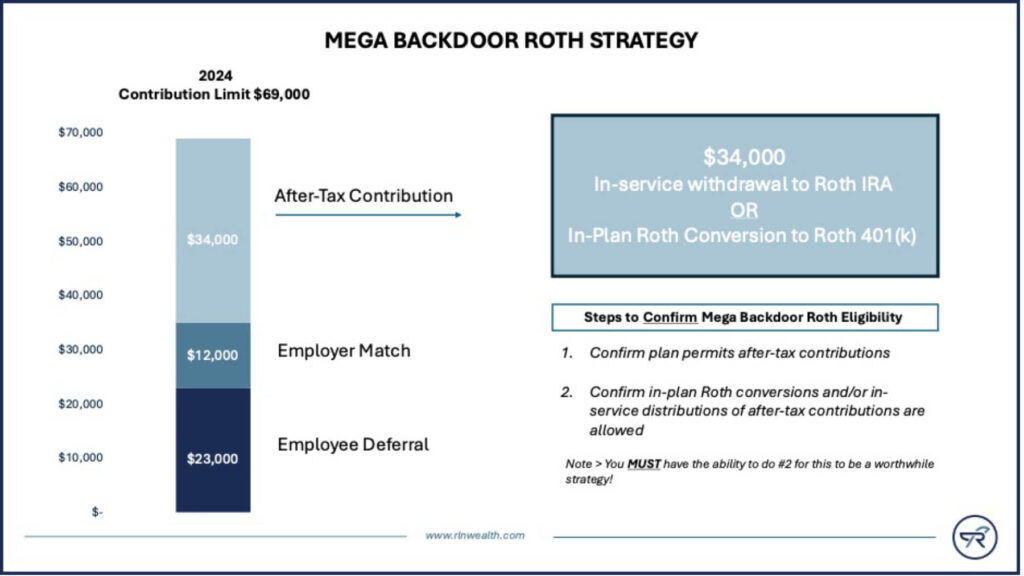

- Most people are aware of pre-tax and post-tax (AKA Roth 401k) contributions to their workplace retirement plan, but a third, lesser-known category exists – ‘After-Tax’ contributions that allow you to top off your retirement plan savings up to the annual contribution limit (2024 – $69,000)

- Eligibility is determined at the plan level – Meaning you’ll have to read your plan documents and/or consult your plan administrator to confirm you’re eligible to make after-tax contributions AND execute in-plan Roth Conversions or initiate in-service withdrawal from your plan (transferring retirement plan funds to an IRA while still working)

The Opportunity – Stacking Cash in a Roth Account

Funds can generally get into your workplace 401k in three different ways. Most contributions are from you (the employee), but if you are lucky, you may also have an employer contribution/match where your company contributes funds to your 401(k) as well. Contribution sources are summarized below –

- Pre-Tax Contributions / Post-Tax (Roth 401k Contributions) – Employee Deferral

- Company Matching Contributions – Employer Contribution

- After-Tax Contributions – Employee Deferral

Let’s look at a quick example to bring the mega backdoor strategy to life. The following visual illustrates the contribution sources noted above, with the following assumptions – The employee contributions $23,000 (The maximum allowable employee deferral in 2024 for those under 50), an employer matching contribution is made in the amount of $12,000, and the remaining opportunity for additional savings is $34,000 of after-tax contributions from the employee.

The Process – Sometimes Automated / Sometimes Painful

The difficulty (and by difficulty, I mean hassle), or lack thereof, to set up the mega backdoor Roth strategy entirely depends on who your 401k provider is and their internal process to execute the following transactions.

- You will need to go online to set up after-tax contributions to your 401k. This is typically in the same place as where you would designate the percentage of your salary you’d like to defer to your pre-tax and Roth 401k.

- After completing step #1, you will need to call your 401k provider (crazy this still has to happen) and let them know you began making after-tax 401k contributions, and you’d like to either 1) Execute in-plan Roth conversion either automatically upon contribution, or periodically at set intervals, or 2) Execute in-service withdrawals either automatically or periodically at set intervals.

The keyword above is ‘automatically.’ Ideally, the entire process can be automated to instantly convert your after-tax contributions to your Roth 401k (in-plan conversion) or Roth IRA(in-service distribution). This is possible, but I’ve seen instances where it cannot be automated, meaning a phone call every few months to initiate the process is required (this would be the ‘hassle factor’ I previously mentioned).

Even if automation isn’t possible it’s still a worthwhile strategy to pursue for the right individual, but I’ve seen countless people opt out strickly due to the hassle factor (Takes too much time, I don’t want to do it).

The Trade-off - Why not just save in a taxable account?

To be honest, for most people this is likely a better strategy. It’s easier to coordinate and your cash is easily accessible, if needed. However, for those with a super-saver mindset and a preference for getting as much cash as possible into Roth accounts ($34,000/year in this example), it’s an incredible strategy.

If you have the cash-flow surplus to make these contributions, the following benefits make this strategy pretty attractive.

- A workaround to Roth IRA funding – If you have the excess cash flow noted above you are almost certainly unable to contribute to a Roth IRA due to IRS income limits.

- Creditor Protection – Investments held in a 401k/IRA have much greater creditor protection (Think lawsuits, bankruptcy, etc.) when compared to taxable brokerage accounts.

- Tax-Free Growth – The younger you are the more beneficial this strategy is as your investment income isn’t taxed on an annual basis like taxable accounts, and all of the appreciation in the account will be tax-free.

The decision - Is this right for you?

There are multiple variables to consider before determining if a mega backdoor Roth strategy is right for you.

- Cash Flow – Do you have excess cash flow to save into an account that ideally goes untouched until retirement?

- Savings Prioritization – You should be maxing out all other retirement, health, and rainy-day savings vehicles prior to exploring the mega backdoor Roth strategy. This means maximum 401k and Health Savings Account (HSA) contributions as well as having a robust emergency fund.

- Meaningful Taxable Investment Accounts – You should have material balances in taxable brokerage accounts to give yourself future optionality in the event you need access to cash. Retirement accounts (by design) make it difficult to get your money out so having another source of liquidity is necessary to avoid taxes and penalties for retirement account distributions.

As you can see, a mega backdoor Roth strategy can be a powerful savings accelerant, but it’s not for everyone. If turbocharging your retirement savings makes sense in the context of your other life goals it may be a good idea to pursue this tax-efficient savings and investment strategy.

Ryan Nelson, CPA, CFP® is a Wealth Advisor based out of Minneapolis / St. Paul and serves clients virtually across the United States. Outside of work Ryan enjoys collecting memories by traveling to tropical locations with loved ones, hosting family and friends at his lake home in Northwest Wisconsin, running, searching for great Italian food, and enjoying an americano from an independent coffee shop.